HelpBnk Users Seeking Investment: Why Community Advice Isn’t Enough to Secure Business Funding (And Where to Find Real Capital)

For the thousands of entrepreneurs using HelpBnk to share their business dreams and seek guidance, one critical challenge remains unresolved: securing the investment capital needed to transform ideas into thriving businesses. While Simon Squibb’s platform excels at fostering community discussions and peer advice, it fundamentally lacks the infrastructure to connect entrepreneurs with actual investors or funding opportunities.

This comprehensive analysis examines why HelpBnk users consistently struggle to secure investment funding, the platform’s inherent limitations in addressing capital needs, and most importantly—where serious entrepreneurs can access real investment opportunities that combine funding with proven business scaling systems.

If you’re using HelpBnk but finding yourself stuck at the advice stage without access to capital, this guide reveals the superior alternatives that successful entrepreneurs use to secure both funding and systematic business development support.

The HelpBnk Investment Gap: A Critical Platform Limitation

Why Entrepreneurs Flock to HelpBnk Seeking Investment

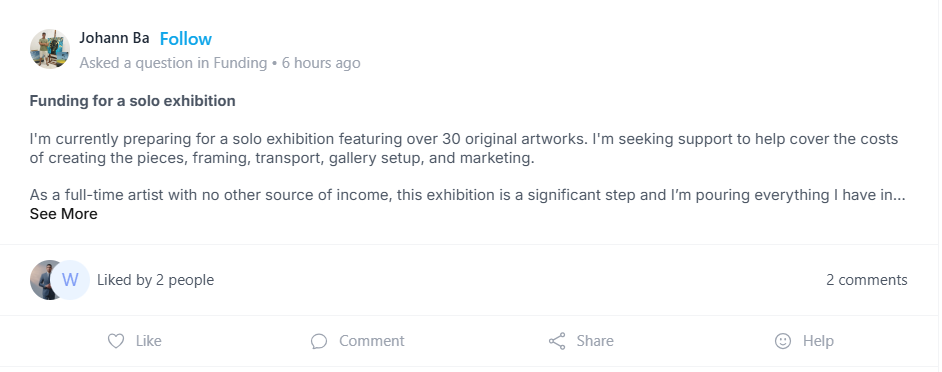

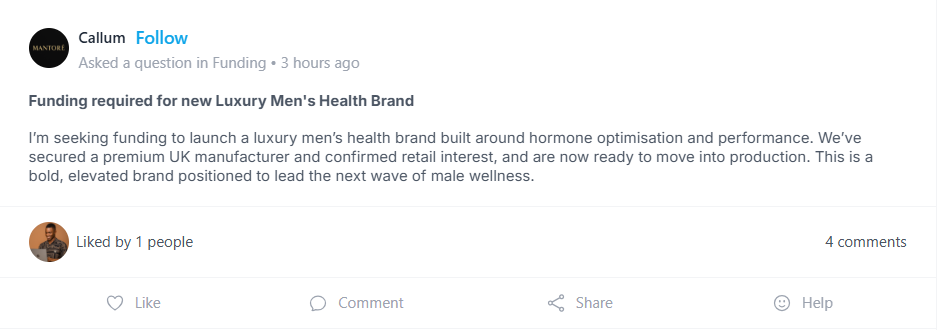

HelpBnk’s community of 80,000+ entrepreneurs includes countless individuals sharing business ideas and explicitly seeking investment opportunities. The platform’s accessible format and encouragement from Simon Squibb’s success story attracts entrepreneurs who believe community support can lead to funding connections.

However, a fundamental disconnect exists between user expectations and platform capabilities. Sourcing enough money to start your new venture can be difficult, requiring more than community advice and peer encouragement.

The Reality of Community-Based Investment Seeking

Despite having a “funding” section and active discussions about capital needs, HelpBnk provides no systematic pathway to actual investors or funding opportunities. Users share their dreams, receive encouragement, and exchange advice—but ultimately leave empty-handed when it comes to securing the capital necessary for business execution.

This creates a cycle of inspiration without implementation, leaving entrepreneurs frustrated and no closer to securing the investment they need to build successful businesses.

Understanding the True Challenges of Startup Funding

The Funding Landscape in 2025

Though VC funding is down, there are still a lot of viable ways to raise cash, but entrepreneurs need access to professional networks and proven methodologies to succeed. Raising capital for your startup can be difficult, but it’s essential for growth.

The challenge isn’t just finding money—it’s accessing the right type of funding from verified investors who understand your industry and can provide strategic value beyond capital.

Common Funding Challenges Helpbnk Can’t Address

One way to overcome this challenge is to have a clear and concise pitch for your business. You should also have a solid business plan that outlines how you plan to use the funds you raise. However, developing these critical components requires professional guidance and systematic frameworks—not community discussions.

Critical funding challenges include:

- Investor Network Access: No connections to verified angels, VCs, or strategic investors

- Investment Readiness: Lack of professional pitch development and business plan optimization

- Due Diligence Preparation: No systematic approach to financial planning and validation

- Valuation Expertise: Inability to properly value businesses for investment discussions

- Legal Framework Understanding: No guidance on equity structures and investment terms

Why Community Advice Fails for Investment Seekers

The Limitation of Peer-to-Peer Funding Guidance

While HelpBnk’s community can provide encouragement and general business advice, securing investment requires professional expertise and verified connections that peer networks cannot provide. Find an individual investor — sometimes called “angel investors” — or venture capital firms. Be sure to do enough background research to know if the investor is reputable and has experience working with startup companies.

This level of due diligence and professional network access is impossible through community platforms focused on dream sharing rather than systematic business development.

The Missing Infrastructure for Real Investment

Successful investment raising requires:

- Verified Investor Networks: Pre-qualified investors with track records and available capital

- Professional Pitch Development: Expert guidance in creating compelling investment presentations

- Financial Modeling: Sophisticated business planning and revenue projections

- Legal Documentation: Proper structuring of investment terms and equity arrangements

- Due Diligence Support: Professional preparation for investor scrutiny

None of these critical components are available through HelpBnk’s community-driven approach.

The Modern Investment Landscape: Beyond Community Platforms

Professional Investment Platforms vs. Community Advice

Startup funding, or startup capital, can involve self-funding, investors and loans. It may be sourced from banks, online lenders, friends and family or your own savings. However, serious entrepreneurs require more sophisticated approaches than those available through community discussions.

Modern investment platforms provide:

- Direct Investor Access: Get equity and front row seats to the startups and small businesses you love—for as little as $100 through platforms like Wefunder

- Professional Infrastructure: AngelList builds the infrastructure that powers the startup economy—providing investors and innovators with the tools to grow

- Accessible Entry Points: On StartEngine, everyday people can invest and buy shares in startups and early stage companies, with Republic allowing investment “with as little as $50”

Alternative Funding Methods Beyond Traditional VC

It’s also worth considering five additional alternative funding methods: crowdfunding, microlending, angel investing, peer-to-peer lending, and startup incubators. These options require professional guidance and systematic approaches—not community advice.

Startup bootstrapping is one of the most common sources of alternative funding. You simply use your own savings or personal credit to fund your venture until you can advance the business to a point where you’re able to attract investors.

Superior Alternatives: Where HelpBnk Users Can Access Real Investment

Comprehensive Investment Partnership Platforms

For HelpBnk users frustrated by the lack of actual funding opportunities, professional business development platforms offer what community advice cannot: direct access to investment capital combined with proven business scaling systems.

The Nick Does Business Investment Partnership Solution

Unlike traditional investors who only provide capital, or platforms like HelpBnk that only provide advice, Nick Does Business delivers what serious entrepreneurs actually need: strategic investment partnerships that combine direct funding with proven scaling systems.

Why Partner With Nick Does Business?

Capital + Expertise Integration We don’t just invest money – we invest our proven systems, expertise, and partnership to guarantee your success. Unlike traditional investors, we bring both financial investment AND our proven systems that have scaled businesses from $0 to 8 figures repeatedly.

Accelerated Growth Through Battle-Tested Systems Our proven scaling frameworks, refined through 20+ years of hands-on business experience across various industries, dramatically compress your growth timeline. These aren’t theoretical methods – they’re battle-tested systems that have generated millions in revenue across multiple industries.

True Partnership Approach We’re not silent partners. We roll up our sleeves and work alongside you, treating your success as our own because it literally is. This collaborative approach ensures your business receives ongoing support throughout the entire scaling journey.

What Nick Does Business Brings to Your Partnership:

Strategic Guidance and Complete Business Playbook Access to our complete business scaling playbook, including marketing funnels, sales systems, and operational frameworks that have generated 8-figure results.

Operational Excellence Implementation Implementation of our proven systems for team building, process optimization, and scalable business operations that allow sustainable growth.

Extensive Professional Network Access Immediate connection to our extensive network of industry experts, potential customers, and strategic partners.

Data-Driven Growth Optimization Our analytics and optimization expertise to identify and capitalize on your highest-ROI growth opportunities.

Investment Readiness: What HelpBnk Users Need

Professional Business Development vs. Community Advice

While HelpBnk provides encouragement, professional investment preparation requires systematic business development that goes far beyond community discussions.

Systematic Business Planning

- Market validation strategies and competitive analysis frameworks

- Financial modeling and revenue projection development

- Operational planning for scalable business infrastructure

- Exit strategy development for maximum value creation

Implementation Support Through Funding Process

- Ongoing guidance through investor meetings and negotiations

- Legal support for investment documentation and terms

- Post-investment mentorship for scaling and growth optimization

- Access to additional funding rounds and strategic partnerships

How to Apply for Nick Does Business Investment Partnership

Are You Ready for Strategic Investment Partnership?

We’re selective about our partnerships because we’re committed to your success. Here’s what we look for in potential partners:

Business Fundamentals:

- Existing Revenue: No minimum revenue required, but you must demonstrate consistent sales that validate market demand and prove your product-market fit

- Scalable Business Model: A proven model with potential for rapid scaling and clear path to 8-figure revenue

- Market Opportunity: Large, growing market with sustainable competitive advantages

Leadership and Commitment:

- Strong Leadership: Founders who are coachable, committed, and ready to implement proven systems

- Alignment: Shared vision for growth and willingness to work collaboratively as true partners

- Implementation Ready: Ready to move fast and implement changes quickly to accelerate growth

Not sure if your business is right for this investment? Submit your application anyway — Our team will provide valuable feedback!

Our Simple Partnership Process

Step 1 – Submit Your Application Submit your detailed pitch including financials, growth plans, and partnership vision through our streamlined application process.

Step 2 – Initial Review Our team conducts preliminary assessment of your business and growth potential, providing feedback within 48 hours.

Step 3 – Deep Dive Analysis Comprehensive business analysis, due diligence, and strategic planning session to identify optimal growth opportunities.

Step 4 – Partnership Terms Negotiate equity stake, investment amount, and partnership structure that works for everyone involved.

Step 5 – Implementation Begin immediate implementation of our proven scaling systems and strategies with hands-on support.

Submit Your Investment Application Today

If you’re a HelpBnk user tired of community advice without access to real capital, Nick Does Business offers the strategic investment partnership you’ve been seeking. We provide both the funding and proven systems necessary to transform your business dreams into scalable, profitable enterprises.

Ready to move beyond HelpBnk’s community discussions to secure real investment for your business? Submit your detailed investment application below and discover how our strategic partnership approach combines capital, expertise, and proven scaling systems for explosive business growth.

Real Investment Success Stories vs. HelpBnk Dream Sharing

Documented Results from Nick Does Business Investment Partnerships

While HelpBnk users share dreams without accessing capital, our strategic investment partnerships deliver measurable outcomes:

Lisa Thompson – Premium Services Inc.

- Investment Partnership: Secured strategic funding and scaling systems

- Result: Scaled from £1M to £15M using systematic business development

- Timeline: 2 years with integrated capital and operational support

Marcus Rodriguez – Urban Lifestyle Co.

- Investment Partnership: Built e-commerce business with funding and systems

- Result: Scaled to £23M and achieved 8-figure exit

- Framework: Professional exit strategy planning from initial investment

Sarah Chen – TechFlow Solutions

- Investment Partnership: SaaS business development with capital injection

- Result: Grew from $2M to $12M in 18 months through automated systems

- Support: Technical implementation team and ongoing optimization

Robert Kim – Venture Group

- Investment Partnership: Online course business development from zero

- Result: Built from £0 to £3M using proven acquisition strategies

- Advantage: Access to investor networks and systematic scaling

The Implementation Difference

The fundamental distinction lies in comprehensive support:

Community Platforms (HelpBnk) Offer:

- General encouragement and peer advice

- Dream sharing without implementation frameworks

- No access to actual capital or investor networks

- Unverified guidance from community members

Nick Does Business Investment Partnerships Provide:

- Direct capital investment AND proven scaling systems

- Systematic business development with measurable milestones

- Access to verified investor networks and funding opportunities

- Expert mentorship with documented track records and relevant experience

The Strategic Investment Partnership Advantage

Beyond Capital: What Serious Entrepreneurs Need

Successful business scaling requires more than just funding. The most effective approach combines:

Strategic Capital Allocation

- Investment tied to proven business development milestones

- Capital efficiency through systematic operational frameworks

- Multiple funding stages aligned with business growth phases

- Strategic partnerships that provide ongoing support beyond initial investment

Operational Excellence Integration

- Team building and management systems for scalable operations

- Technology infrastructure and automation implementation

- Process optimization and efficiency maximization frameworks

- Quality control and standard operating procedure development

Market Expansion and Revenue Multiplication

- Customer acquisition systems that operate independently

- Revenue stream diversification and lifetime value optimization

- Market penetration strategies and competitive positioning

- Sales funnel development and conversion rate optimization

The True Partnership Model

Unlike traditional investors who provide capital and expect returns, strategic investment partnerships offer shared success frameworks:

Aligned Incentive Structures

- Success metrics tied to business performance rather than just financial returns

- Ongoing support throughout entire business lifecycle

- Exit strategy planning that maximizes value for all parties

- Long-term relationship focus rather than transaction-based interactions

Comprehensive Success Framework

- Business development support from conception through exit

- Access to professional networks and strategic partnerships

- Ongoing mentorship and guidance through scaling challenges

- Technical implementation support for complex business systems

Making the Transition from HelpBnk to Real Investment

Identifying Your Investment Readiness

Before seeking strategic investment partnerships with Nick Does Business, HelpBnk users should assess their business development stage and readiness for professional partnership.

Ideal Candidates for Investment Partnerships:

- Existing revenue streams demonstrating market validation and product-market fit

- Scalable business models with clear growth potential and competitive advantages

- Strong leadership teams ready to implement systematic business development

- Commitment to following proven methodologies rather than experimental approaches

- Clear vision for growth with willingness to work collaboratively as strategic partners

Investment Partnership Prerequisites:

- Demonstrated business traction beyond idea stage

- Willingness to implement systematic operational frameworks

- Commitment to professional business development processes

- Long-term vision aligned with strategic partnership goals

- Readiness to move beyond community advice to professional implementation

The Professional Investment Process

Stage 1: Business Assessment and Strategic Planning

- Comprehensive business analysis and growth potential evaluation

- Market opportunity assessment and competitive positioning review

- Financial modeling and revenue projection development

- Operational framework planning and scalability analysis

Stage 2: Investment Structure and Partnership Terms

- Equity stake determination based on mutual value creation

- Investment amount calculation tied to specific business milestones

- Partnership agreement development with shared success metrics

- Legal documentation and due diligence completion

Stage 3: Implementation and Scaling Execution

- Immediate deployment of proven business development systems

- Technical infrastructure setup and automation implementation

- Team building and operational process optimization

- Ongoing monitoring and strategic adjustment protocols

Conclusion: From HelpBnk Dreams to Investment Reality

For the thousands of HelpBnk users seeking investment opportunities, the platform’s community-driven approach represents a fundamental mismatch between user needs and available resources. While dream sharing and peer encouragement have value, securing business investment requires professional networks, proven methodologies, and systematic approaches that community platforms cannot provide.

The Critical HelpBnk Limitations for Investment Seekers:

- No access to verified investor networks or funding opportunities

- Lack of professional pitch development and investment readiness support

- Absence of systematic business planning and financial modeling guidance

- No legal framework support for investment documentation and terms

- Community advice without professional implementation support

The Nick Does Business Investment Partnership Advantage:

- Direct access to strategic capital combined with proven scaling systems

- Comprehensive business development support throughout entire growth journey

- Verified track records with documented success stories and measurable outcomes

- Professional networks providing ongoing strategic partnerships and opportunities

- Systematic implementation support ensuring successful execution of growth plans

The Bottom Line: HelpBnk serves as an inspirational platform for sharing entrepreneurial dreams, but serious entrepreneurs seeking investment capital require professional partnerships that combine funding access with systematic business development support.

The most successful entrepreneurs recognize that securing investment is just the beginning—building scalable, profitable businesses requires proven systems, expert guidance, and ongoing professional support that community platforms cannot provide.

For HelpBnk users ready to move beyond dream sharing to actual business building, Nick Does Business offers the comprehensive investment partnership necessary to transform entrepreneurial visions into successful, scalable enterprises.

Your business deserves more than community encouragement—it deserves professional investment partnerships that provide both the capital and proven systems necessary to achieve sustainable, profitable growth.

The choice is clear: continue seeking advice on community platforms, or access the strategic investment partnerships that successful entrepreneurs use to build and scale 7 and 8-figure businesses.

Ready to move beyond HelpBnk’s community advice to secure real investment for your business? Apply now for a strategic investment partnership with Nick Does Business, where you’ll receive both the capital and proven scaling systems necessary to build a successful, scalable business.

Visit nickdoesbusiness.com/investment to submit your investment application today.

Join the entrepreneurs who’ve transitioned from seeking community advice to securing strategic investment partnerships and achieved measurable, life-changing business outcomes through professional capital and systematic business development.